Tariff Engineering: Designing Duty-Free Products, Not Chasing Refunds

What is “tariff engineering”?

Tariff engineering is the perfectly legal art of tweaking a product’s materials, firmware or assembly flow before it crosses the border so that it fits a lower-duty HS code. Think of it as “design for duty reduction.” A felt strip on Converse sneakers turns them into house-slippers, mutant action figures become “non-human toys,” and a camera’s firmware stops recording at 29 m 59 s so it isn’t taxed as a camcorder. readtrung.com

Done right, the savings dwarf most post-entry programs because no duty is paid in the first place—cash never leaves the importer’s P&L, there is no refund lag, and compliance risk is front-loaded into a single binding-ruling exercise rather than year-after-year claims.(ryrob.com)

1 / Tariff engineering vs. the usual duty-relief toolkit

| Program | When the cash leaves your account | Typical savings | Ongoing admin |

|---|---|---|---|

| Tariff engineering | Never—design ships in under a cheaper HS code | 5-40 pp (often to 0 %) | One-off design tweak + binding ruling |

| Duty drawback | Up-front, then 3-6 mo wait for the refund | Up to 99 %—if you later export or destroy | Serial-number tracing, claim filings |

| FTZ / bonded warehouse | Deferred until goods leave the zone | Suspension, not elimination | Zone inventory system |

| Section 321 de-minimis | Never (< $800/parcel) | 100 % | Parcelisation, express carrier |

| Country shift / trans-shipment | Case-by-case | Variable | New supply chain, circumvention risk |

Bottom line: when tariff engineering is feasible, it normally wins on net savings and paperwork. The rest become fallback options.

2 / How tariff engineering actually works

Sony’s PlayStation 2 and Apple’s iPod show how very different products can ride the same tariff-engineering logic. When Sony launched the PS-2 in Europe, the console faced a 2.2 percent duty under heading 9504 for “video-game machines.” Sony tried to neutralise that charge by selling an optional “Linux Kit” (hard-drive, keyboard, mouse and Debian-based OS) and arguing the hardware was, in essence, a general-purpose computer—qualifying for duty-free treatment in heading 8471. Although the European Court of Justice eventually ruled that the machine’s “essential character” remained a game console, the episode made clear that if Sony had met the test the tariff would have fallen from 2.2 percent to zero on every shipment.

Apple’s iPod story is the mirror image in the United States: early colour-screen iPods drew duties of five to thirteen percent because Customs treated the player as a video display (chapter 8528). Apple rewrote the narrative in firmware and marketing materials to show that the device’s principal function was sound reproduction, not video playback. Customs accepted the argument, re-classifying the iPod under heading 8519 at just two percent duty. Millions of units later, that firmware-level tweak had wiped out up to eleven percentage points of tariff—savings that never had to be reclaimed through drawback or post-entry refund schemes. Together the two cases illustrate the same rule: if you can legally shift a product’s “essential character,” the duty line on the customs entry shifts with it, eliminating cost before it ever hits the P&L.

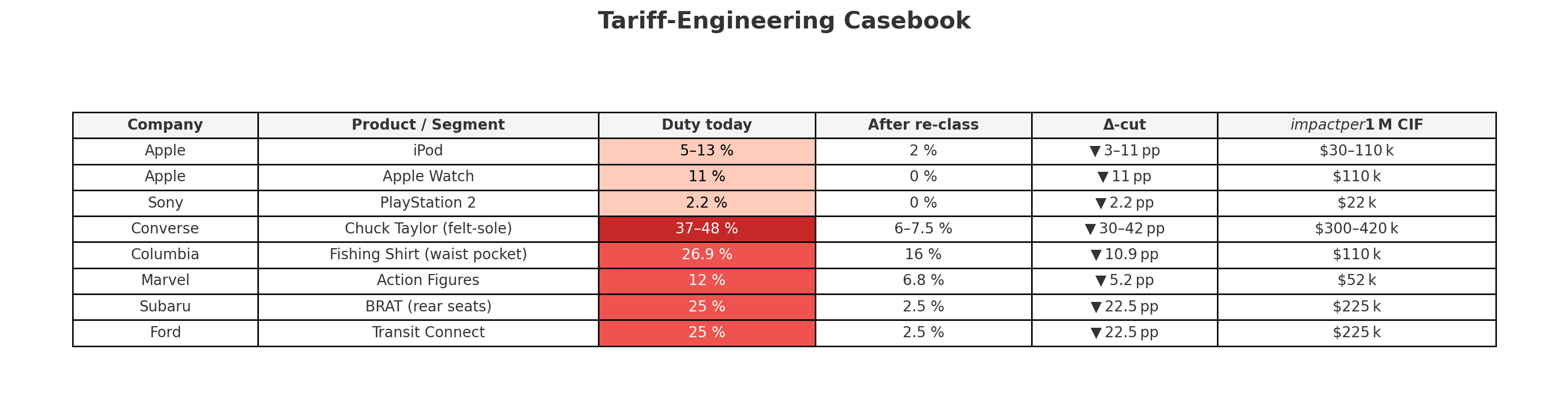

They are not the only two companies that are using tariff engineering:

3 / “the best HS code” beats “the right HS code”

For many SKUs multiple equally lawful HS pathways exist, often separated by a tiny design choice:

- Outer-shell ≥ 55 % polyester → duty-free as knit top;

- < 55 % → 16–27 % MFN.

Both are “right”; one is better. The art is:

Mapping every possible variant against tariff notes and rulings.

Simulating landed-cost scenarios.

Quantifying ROI on each tweak.

Packaging proof so an auditor (or your CFO) sees bullet-proof compliance.

Humans can’t iterate 18000 tariff lines, but with Portwise.ai, you can!

We are introducing Tariff-Engineering Copilot (beta) plugs straight into your tech packs or BOM spreadsheets:

- Upload drawings, fabric spec, CAS numbers, even firmware descriptors.

- AI HS Explorer trawls every CBP/EU/UK ruling, highlights 2–4 defendable codes, and tags the design changes needed to hit each one.

- Duty Simulator recalculates duties, VAT and excise in real time so product, finance and supply-chain all see the pay-back.

- One-click ruling brief exports the winning scenario with lab reports and legal arguments ready for counsel.

- Continuous watch-list pings you if a court decision or rate change up-ends yesterday’s cheapest code.

Result: no spreadsheets, no six-month refund lags, no guessing. Just the lowest lawful duty your design can achieve—locked in before your goods leave the factory.

4 / Ready to stop over-paying?

If a $1 coating and a firmware flag can wipe out double-digit duties, imagine what Portwise will uncover across your entire catalogue.

→ Book a 30-minute demo and let us show you the cheapest, audit-proof HS code your next shipment can sail under.

Design smarter. Pay fewer duties. That’s tariff engineering—automated by Portwise.