Product Hot-Zones in the 2025 Tariff Wave: are you prepared for the Aluminum double rate?

1 | The big headline hides a very product-specific story

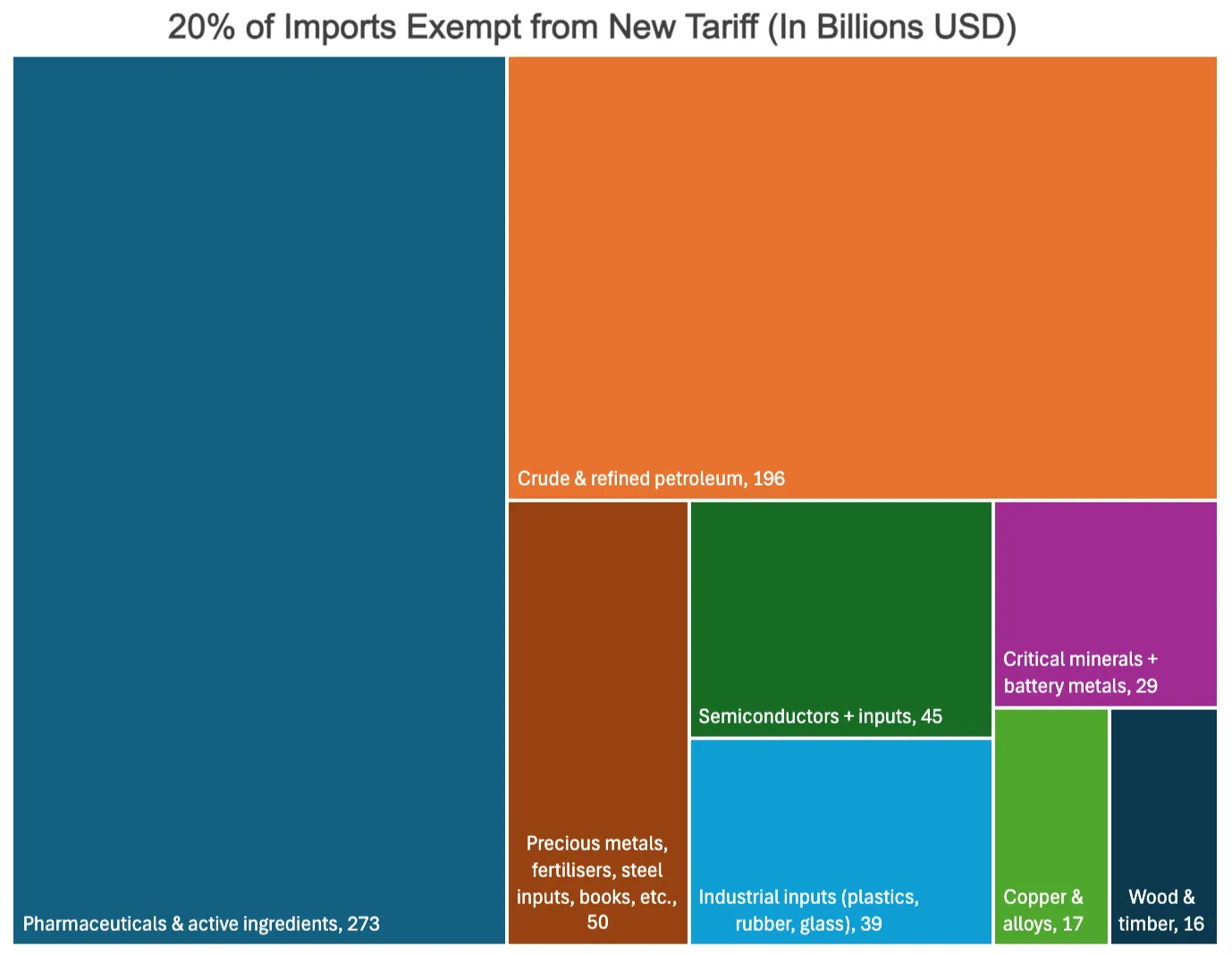

Media coverage of the April–May tariff surge has focused on the headline numbers—“average U.S. tariff could top 20 %.” Yet buried in Annex II of the presidential proclamation is a two-column spreadsheet showing exactly which HS-6 lines get a hall-pass. When we group those lines by commodity, a striking pattern emerges —see below.

Roughly one-fifth of all 2024 imports—about $665 billion—are exempt from the new baseline duty.

Source: Annex II, U.S. Census import values.

2 | Why these sectors dodged the bullet

- Pharma & APIs Washington wants secure drug supply but can’t afford a price shock during an election year; 85 % of U.S. antibiotics and 65 % of generic APIs are still sourced abroad.

- Energy inputs Crude, refined products and LNG remain exempt to avoid self-inflicted pain at the pump.

- Semiconductors CHIPS Act incentives hinge on cheap wafer imports while domestic fabs ramp up; the White House quietly confirmed these HS lines stay duty-free “for national security reasons.”

- Critical minerals Even as the U.S. pursues friend-shoring, lithium, cobalt and rare-earth oxides made the carve-out list so that battery OEMs don’t stall.

Put differently: tariff policy is less about broad protectionism and more about selective pressure—raising costs where alternative suppliers exist (consumer electronics, finished metals) while insulating the parts of the economy that would scream loudest at a sudden cost spike.

3 | Aluminium: the new poster-child for sector-specific pain

While semiconductors got a hug, aluminum is back under the hammer. The Atlantic Council’s Trump Tariff Tracker logs a fresh Section 232 action on 10 February 2025:

| Metric | 2018 “232” round | 2020 Canada/Mexico carve-out | 2025 action |

|---|---|---|---|

| Base duty | 10 % | 0 % (Canada/Mexico) | 25 % |

| Scope | Alloy + unwrought | Same | Same (removes NAFTA carve-out) |

| Legal authority | Section 232 | Section 232 | Section 232 |

| Citation | Procl. 9705 | Procl. 10060 | Procl. 10895 (90 FR 11251) |

What changed?

- The new proclamation wipes away the quota-for-duty swap with Canada and Mexico, putting their billet and slab back under the 25 % umbrella.

- Finished downstream products (cansheet, extrusions) remain on the 10 % line—but insiders expect the Commerce Department to “harmonise” those rates in Q3.

- Early July is the go-live date; importers have just weeks to reroute or apply for exclusions.

4 | How the tracker data map onto real supply chains

The CSV log of every 2025 action shows three clear clusters:

- Economy-wide tariffs (79 entries) —blanket 10–30 % rates on “non-reciprocal” trading partners.

- Sector-specific hits (11 entries) —metals, electric vehicles, and large household appliances.

- One-off suspensions (1 entry) —the lone “Other” row, removing duties on baby formula inputs to quell last year’s shortage.

Aluminum sits in the second cluster—a surgical strike that raises the landed cost on a narrow slice of HS codes while the pharma–energy bloc coasts tariff-free.

5 | What importers should do next

- Map your HS-6 exposure. Treemap categories hide thousands of line items. Use a rules-based scanner to flag any HS 7601, 7604 or 7606 positions (aluminum), but ignore HS 2710 (fuel) and 3004 (finished meds) for now.

- Audit your certificates of origin. The Section 232 rate applies regardless of origin unless a product is melted-and-poured in the U.S. or qualifies for an exclusion—documentation is king.

- Explore tariff-engineering pivots. Aluminum cansheet that exceeds 0.2 mm thickness can sometimes be classified under an alloy heading that still sits at 10 %. Small tweaks in gauge or temper may pay for themselves in weeks.

- Leverage Section 321 de-minimis for finished consumer goods. Individual beverage cans are unlikely to meet the $800 threshold, but accessories and small hardware parts often do.

6 | How Portwise can help

Portwise ingests your customs data, cross-references every line with the Tariff Tracker, and then:

- Alerts you when a newly effective duty hits an HS code in your BOM.

- Suggests alternative compliant classifications (gauge, alloy or temper tweaks) to slip into lower brackets.

- Generates the paperwork for a 232 exclusion request—complete with supply-risk justification and U.S. production search results—in minutes, not weeks.

Bottom line: Tariff waves are becoming more product-surgical every month. Knowing which line items are safe, which are now toxic, and which can be engineered into cheaper HTS codes is the new moat. Plug your data into Portwise and turn the tariff tables back in your favor.