How Tariffs Are Re-routing Global Trade Map

A quick reset on the tariff map

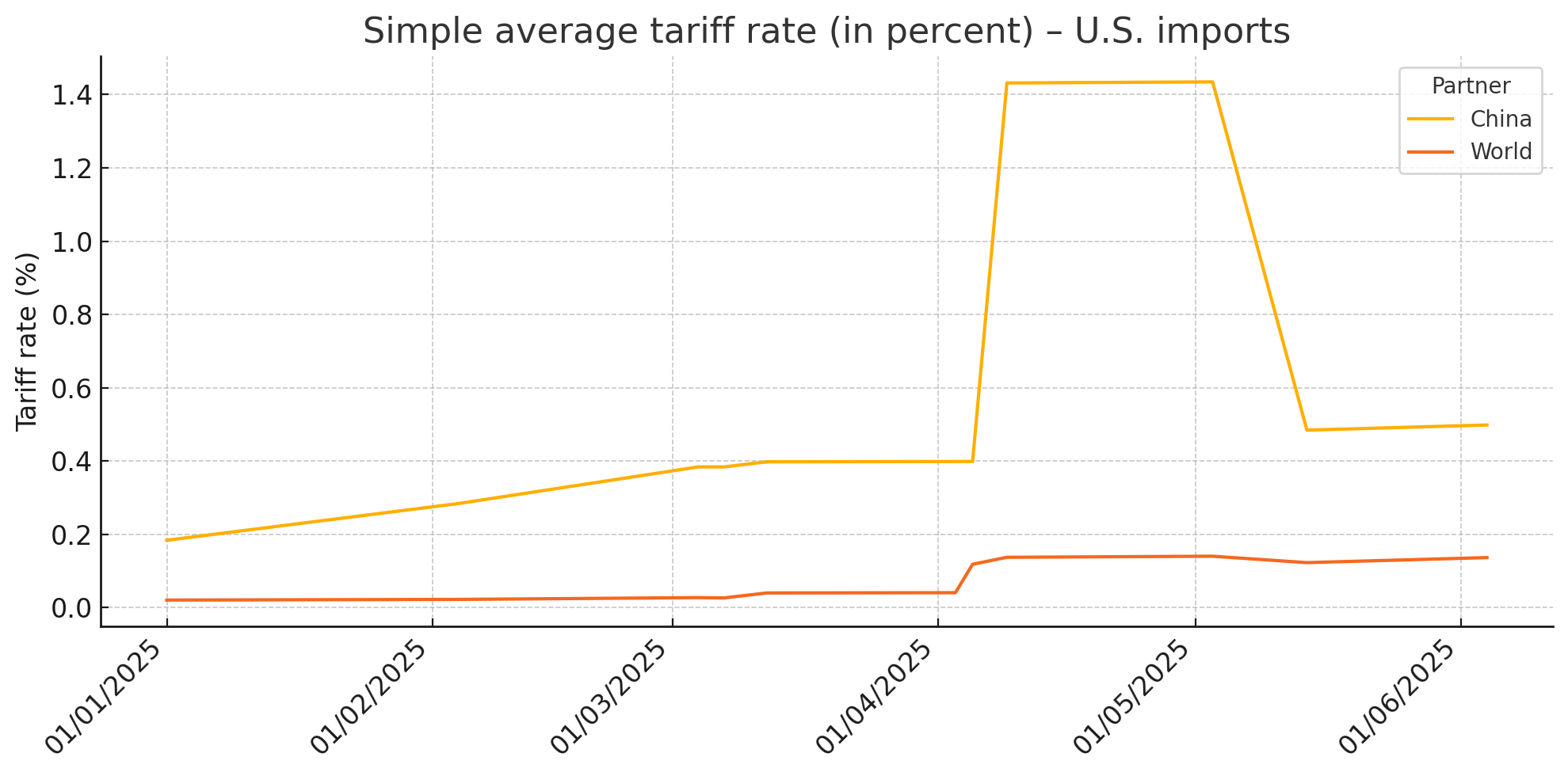

In a span of barely four months—February to May 2025—the United States pushed its average applied tariff above Great-Depression peaks, while China, the EU and several emerging economies responded in kind. The IMF calls it “a flurry of tariff announcements… ushering the world into a new era” and warns that global trade growth will slide to 1.7 % in 2025, noticeably below output growth.(imf.org) The World Bank’s Global Economic Prospects update echoes the concern, noting that rising tariffs and policy uncertainty are already shaving almost a full percentage point off the 2025–26 world-GDP forecast.(worldbank.org) WTO monitoring reports count more than 1 400 new trade-restrictive measures since 2023, with tariffs the single largest category.(wto.org)

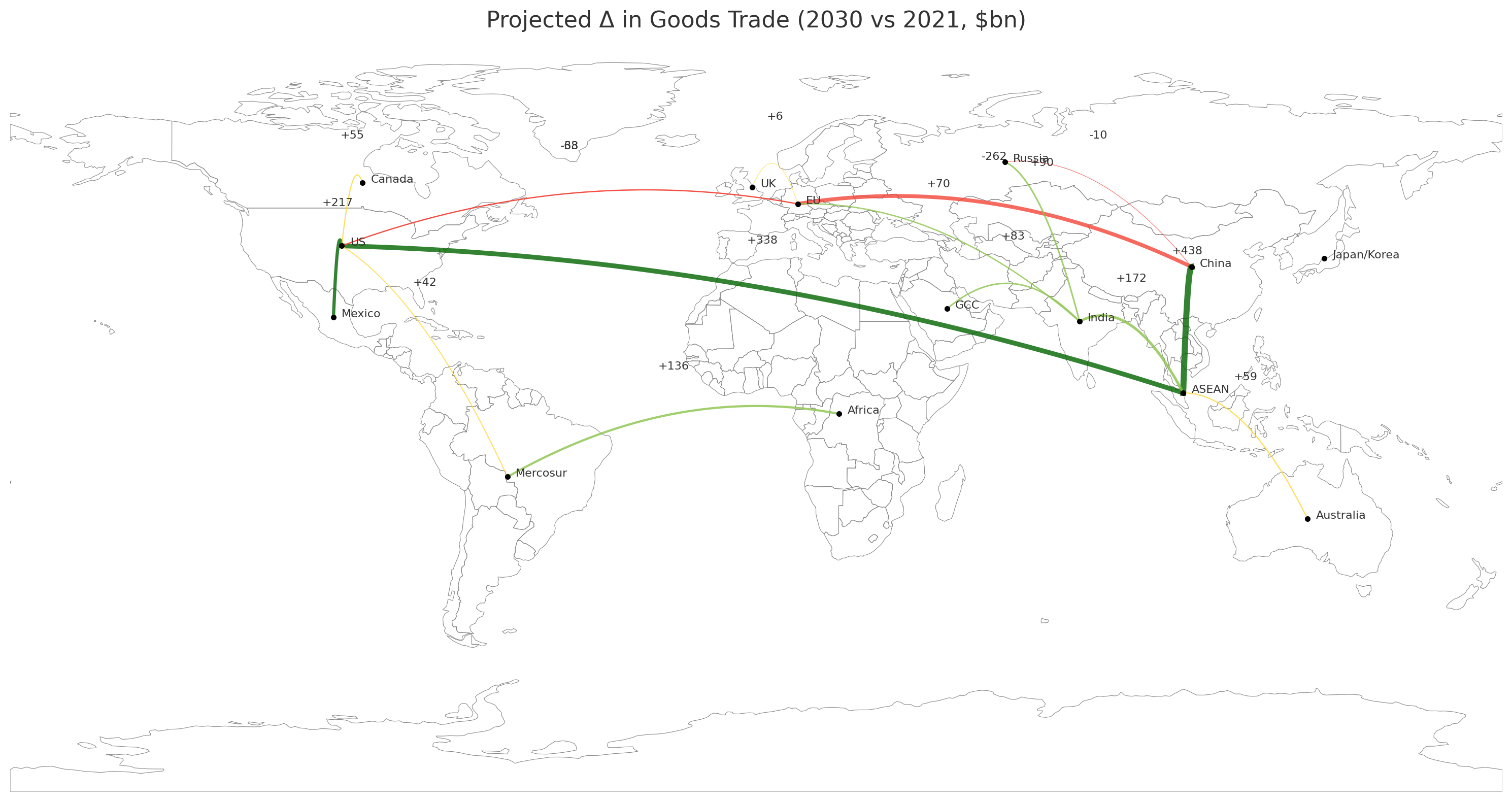

Put simply: the price of crossing borders is going up, and supply chains are responding exactly as textbooks predict—by bending, re-routing or even leap-frogging entire regions.

When duties move, so do the trade lanes

A new UNCTAD working paper tracks U.S. import patterns from 2017-22 and finds the sharpest market-share losses for China in sectors hit hardest by tariffs, with third-country suppliers filling the gap.(unctad.org) Reuters reporting gives the phenomenon real-time colour:

- Vietnam as the detour of choice. After successive Section 301 hikes, U.S. goods imports from Vietnam have more than doubled versus 2018, while Vietnam’s own imports from China rose in almost perfect lock-step—a 96 % correlation, according to World Bank estimates.(reuters.com)

- Near-shoring whiplash. Firms that shifted assembly from China to Mexico or Canada during the first round of China tariffs now face fresh 25 % levies on those neighbours as well, prompting a second round of route re-design—or outright production pauses while executives “wait for the dust to settle.”(reuters.com)

- Trans-shipment crackdowns. Hanoi, under U.S. pressure, is tightening rules on “Made in Vietnam” labels precisely to stop Chinese goods from making tariff-dodging pit-stops in Vietnamese ports.(reuters.com)

- Steel finds fewer doors. Chinese steel mills, long accustomed to shipping through third countries, now see exports falling by up to 20 % quarter-on-quarter as Washington, Seoul and Hanoi all slap duties on re-routed metal.(reuters.com)

The redirection isn’t limited to Asia–U.S. lanes. A World Economic Forum brief highlights how cities like Tangier, Ho Chi Minh and Monterrey are racing to expand ports, FTZs and road links precisely to catch the spill-over from tariff-driven factory moves.(weforum.org)

What this means for traders

- Longer supply chains, higher compliance risk. Each additional border crossing multiplies documentary requirements and origin-verification headaches—exactly the terrain where customs audits thrive.

- Volatile landed costs. While a Vietnam or Mexico detour may look cheaper today, any hint of “trans-shipment” can bring retroactive duties, penalties and brand damage tomorrow.

- Strategic value of classification. As duties proliferate, how a product is classified (HS code, origin rule, valuation method) often matters as much as where it is shipped from. A well-engineered HS shift can sidestep tariffs without the gymnastics—and risks—of route hopping.

Navigating the new maze

Portwise’s AI Copilot was built for exactly this landscape. Feed it your bill of materials and routing options, and it will:

- Simulate duty exposure across multiple HS codes and multiple routing scenarios.

- Flag trans-shipment red flags by checking value-addition thresholds against local input data.

- Surface alternative duty-free or preference programs (FTAs, de-minimis, FTZ admission) before you redraw your logistics map.

Because the cheapest shipment is the one that clears the border cleanly the first time—no matter how many detours the tariff map throws in its way.

Want a lane-by-lane stress-test of your current routes?

→ Book a 30-minute demo and see where your supply chain could save—or where it might already be flashing red.